transfer taxes refinance georgia

13th Sep 2010 0328 am. The borrower and lender must remain unchanged from the.

Easily estimate the title insurance premium and transfer tax in Georgia including the intangible mortgage tax stamps.

. Sales Use Tax Policy Bulletins. Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. Sales Use Tax Regulations.

If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. The Georgia intangibles tax is exempt on refinance transactions up to the amount of the unpaid balance on the original note. I am refinancing my current mortgage and one of my potential lenders is stating that I need to a pay a mortgage transfer tax at closing.

Sales Use Taxes Fees Excise Taxes. State of Georgia Transfer Tax. Comparing lenders has never been easier.

Note that transfer tax rates are often described in. On any amount above 400000 you would have to pay the full 2. The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed.

Competitive Rates Fast Approval. GILA taxes collected for the period July 1 through December 31 of each year shall be remitted to the department no later than the first business day of March of each year. The Georgia intangibles tax is exempt on refinance transactions up to the amount of the unpaid balance on the original note.

Get Started Today as Rates are Increasing. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Ad FInd the Best Refinance Option Just for You Start to Refinance Your Existing Home Loan.

Ad Its A Home Loan Do-Over. Comparing lenders has never been easier. 1 Intangible recording tax is not required to be paid on that part of the face amount of a new instrument securing a long-term note secured by.

Refinance Your Mortgage With Low Rates From Citizens. Ad Compare top lenders in 1 place with LendingTree. Once the tax has been paid the clerk of the superior court or their deputy will attach to the deed instrument or other writing a certification that the tax has been paid.

Ad Our Trusted Reviews Help You Make A More Informed Refi Decision. In a refinance transaction where property is not. Ad Compare top lenders in 1 place with LendingTree.

Recording Transfer Taxes. 07th Sep 2010 0515 pm. Title insurance is a closing cost for purchase and refinances mortgages.

Best Mortgage Refinance Lenders Compared Reviewed. Find Out How Much You Can Save With Citizens. Here are six of the most common mistakes that homeowners make when refinancing their mortgage.

Thinking refinancing all about the rate. As a first-time home buyer you would only have to pay a 75 transfer tax for a home price of up to 400000. When you refinance your mortgage youre.

Comparisons Trusted by 45000000. To avoid fines for. Ad 2021s Trusted Mortgage Refinance Reviews.

Sales Use Tax Letter Rulings. 2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-1 - Transfer tax rate 48-6-2. The real estate transfer.

What You Should Know About Contra Costa County Transfer Tax

Who Pays What In The Los Angeles County Transfer Tax

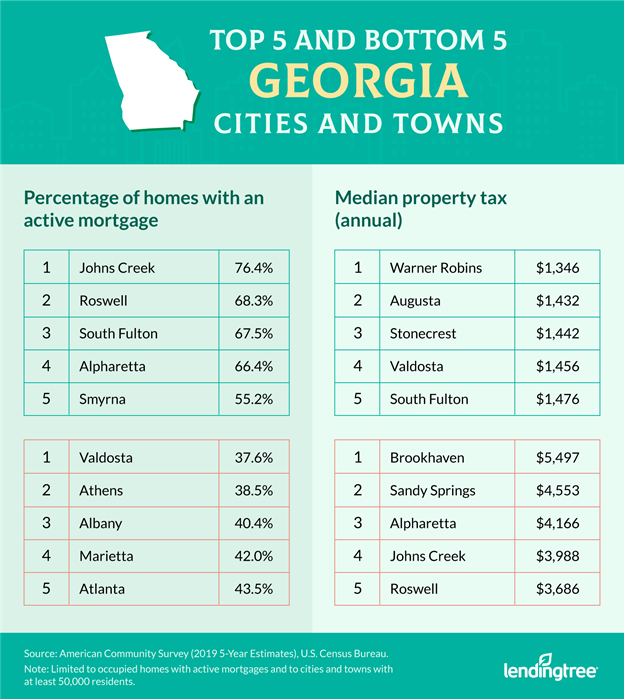

Mortgage Rates In Georgia Plus Stats

Georgia Title Transfer Tax Intangibles Tax Mortgage Tax

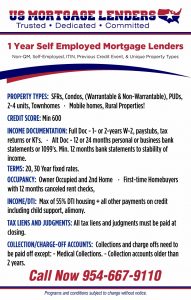

Georgia 12 Month Bank Statement Mortgage Lenders

Georgia In Imf Staff Country Reports Volume 2020 Issue 223 2020

Georgia Real Estate Transfer Taxes An In Depth Guide

Georgia 12 Month Bank Statement Mortgage Lenders

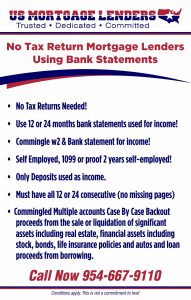

Georgia No Tax Return Bank Statement Mortgage Lenders

What You Should Know About Contra Costa County Transfer Tax

Georgia Title Transfer Tax Intangibles Tax Mortgage Tax

What Are The Costs Associated With Selling A Home In Georgia Brian M Douglas

Transfer Tax Alameda County California Who Pays What

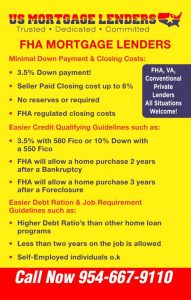

3 5 Georgia Fha Mortgage Lenders Min 580 Fico

Georgia Quit Claim Deed Forms 7 Things You Need To Know The Hive Law