nh food tax rate

There are however several specific taxes levied on particular services or products. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT.

Meals And Rooms Tax Nh Issue Brief Citizens Count

New Hampshire has a flat corporate income tax rate of 8500 of gross income.

. The breakdown below represents what contributes to the tax rate. 2131 2848 2696 2723 2601 2510 947 Revaluation Year Values Increased 786 838 882 911 966 Revaluation Year Values Increased 2015. So the tax year 2022 will start from july 01 2021 to june 30 2022.

New Hampshire meals and rooms tax rate drops beginning Friday. 2648 95 2014. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on.

For districts and towns within districts the following items are reported. The tax rate for each package containing 20 cigarettes or little cigars is 178 per package. Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the customer receipt or check.

Beth Rouse 603 529-7526. New hampshire does not have any state income tax on wages. The tax rate for each package containing 25 cigarettes or little cigars is 223 per.

NHgov privacy policy accessibility policy. Multiply this amount by 09 9 and enter the result on Line 2. Meals paid for with food stampscoupons.

Prepared Food is subject to special sales tax rates under New Hampshire law. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. November 23 2021 - 102pm.

15 Flanders Memorial Road. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. Assessed valuation equalized valuation total tax assessment school tax assessment the portion of revenue.

Meals paid for with food stampscoupons. The NH Department of Revenue Administration has finalized the Towns 2021 tax rate at 1942 per thousand dollars of assessed value. The 2021 tax rate is 1768 per 100000 of assessed valuation.

Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration. Food Service guidance issued on May 18 2020. Town of Weare 15 Flanders Memorial Road Weare NH 03281 603-529-7575 Website.

2021 Tax Rate Computation. Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room.

Tax Bracket gross taxable income Tax Rate 0. 603 230-5945 Contact the Webmaster. The new tax rate has been set by the state - 1950 per thousand of your assessed value.

The 2021 Equalization Ratio is 945. New hampshire does not have any state income tax on wages. Concord NH 603 230-5000 TDD Access Relay NH.

That is an increase of 066 or 35 compared to 2020. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. So the tax year 2022 will start from july 01 2021 to june 30 2022.

45 rows Annual Tax Rate Determination Letters mailed by September 2 2022 for the tax. 2021 2020 2019 2018 2017 2016. The federal corporate income tax by.

A 9 tax is also assessed on motor. Tax rate drops from 9 to 85. The ratio for 2021 is 961 the 2022 ratio has not been established yet by the Department of Revenue.

New Hampshire Sales Tax Handbook 2022

New Hampshire Cuts Tax On Rooms Meals To 8 5 Cbs Boston

State Taxes On Capital Gains Center On Budget And Policy Priorities

Illinois Gas Taxes Among Highest In Nation Axios Chicago

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

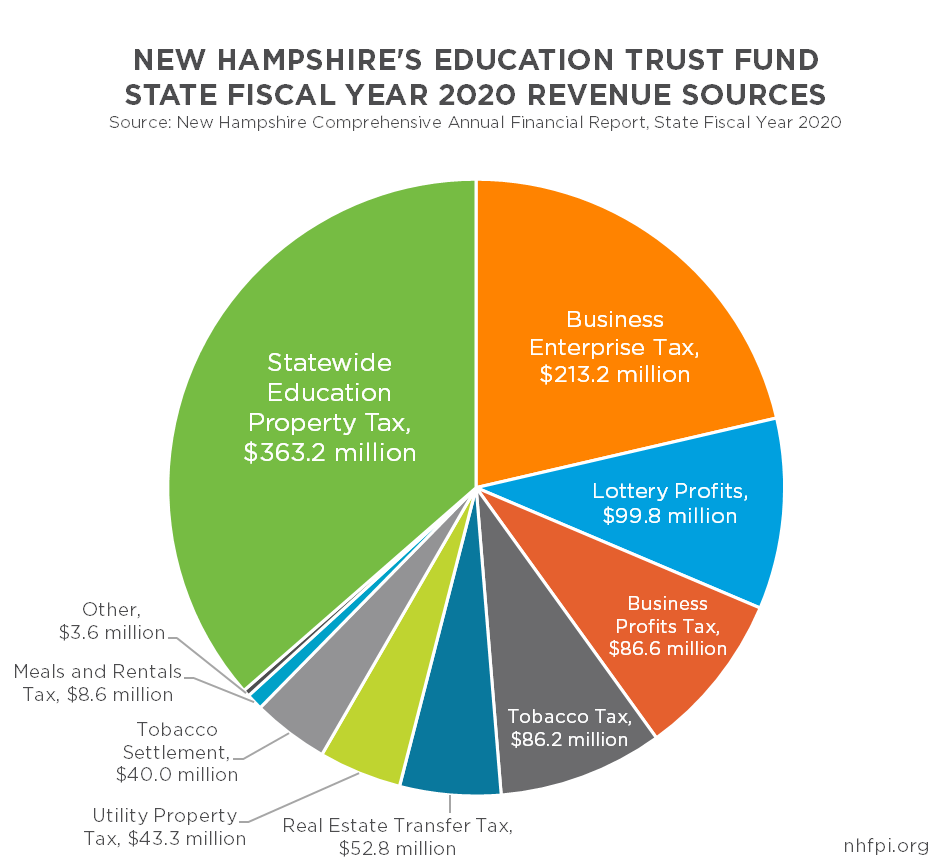

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

New Hampshire Income Tax Calculator Smartasset

Taxes In The Uk Vs Us Where Do You Pay More

Everything You Need To Know About Restaurant Taxes

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute